Using Prediction Markets to Raise Climate Concern

Participation in climate markets bolsters backing for anti-warming measures

For the vast majority of our existence on earth, the fight for survival has been a daily battle. Whether it was trying to hunt and forage for food, avoid predators, or dodge disease, most human beings have not enjoyed the luxury of planning ahead and have been forced to think about only the present.

Today, despite advancing technology, that hard-coded wiring is working against us. Perhaps the biggest example is climate change, potentially an existential threat to humanity but one for whom the greatest threat is to future generations. However, according to a Gallup survey this year, 40 percent of the US population believes the seriousness of global warming is exaggerated. They are therefore unlikely to elect politicians espousing the increasingly costly policies necessary to reach emissions targets.

Northwestern Engineering’s Malcolm MacIver has devised a method that could incentivize change.

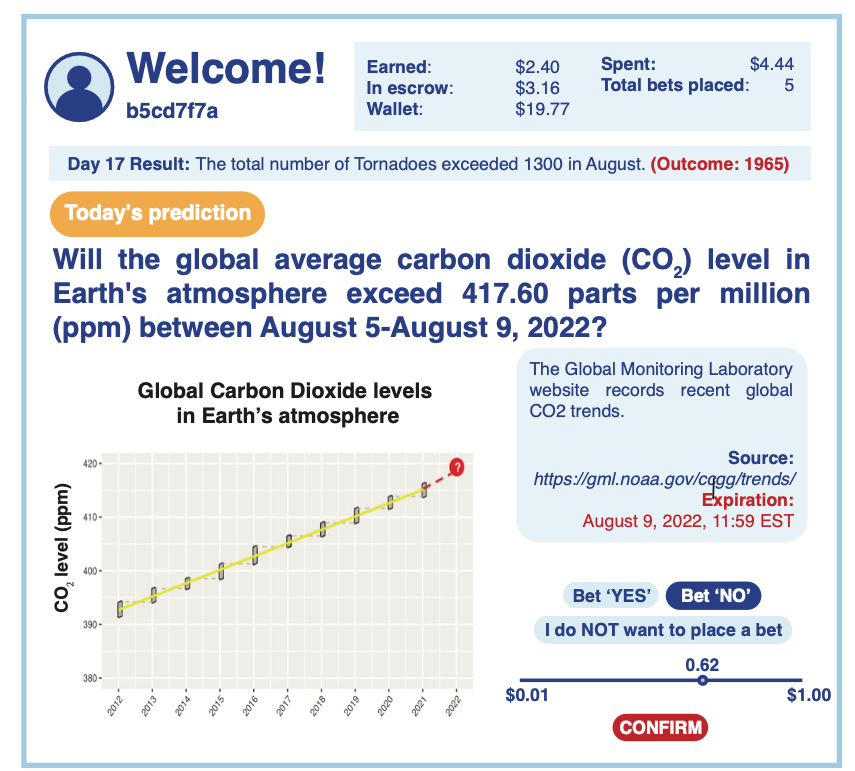

Working with collaborators at Columbia Business School in one of two similar studies, MacIver’s month-long experiment separated study participants into two groups of 330 people each. Each member of one cohort was given $20 to invest in a sports and entertainment prediction market; the other cohort was handed $20 to invest in a climate prediction market where they were asked questions about climate-change related events like the number of wildfires or hurricanes over the coming weeks.

While people in the sports and entertainment group were unchanged in their level of climate concern, MacIver and colleagues found that participation in the climate market increased those members’ concern about global warming, support for costly policies to mitigate the risks of climate change, and knowledge about climate issues. This was evident across participants’ levels of initial belief in climate change and political ideology.

While many engineering innovations are occurring to help us achieve future emissions targets, ultimately massive changes are needed across all sectors of the economy, and these changes will be costly. Engineering breakthroughs are at risk of being unused until the level of concern rises to where politicians are able to enact costly policies. This is an unsolved problem the new study addresses.

“When you have people put their money where their mouth is with respect to climate, people increase their level of concern about global warming,” MacIver said. “This effect is across liberals and conservatives, and it’s even slightly stronger in conservatives than liberals.”

When you have people put their money where their mouth is with respect to climate, people increase their level of concern about global warming.

Malcolm MacIverProfessor of Biomedical Engineering and Mechanical Engineering

Moving forward, MacIver hopes to see the market piloted at a city- or state-wide level to allow citizens to partake in a climate-prediction market, with each citizen funded by a portion of lottery ticket or sports betting tax proceeds. The better citizens attune to climate-change related events being predicted on the market, the more money they could earn to keep. The results of the study suggest that the more people play, the more they keep tabs on the environment and think long-term about the climate instead of their short-term finances.

“If it works in the manner our study shows, that says something really powerful that could have global consequences,” MacIver said.

MacIver is a professor of biomedical engineering and mechanical engineering at the McCormick School of Engineering. The findings were reported in two articles, “Participating in a Climate Prediction Market Increases Concern about Global Warming” and an accompanying invited policy brief “Participating in a Climate Futures Market Increases Support for Costly Climate Policies,” the cover story of the June 8 issue of Nature Climate Change.

Much of MacIver’s recent work has been focused on how animals are able to imagine future outcomes and select an action now that leads to the best future. Because of that research, MacIver is aware of the brain’s challenge in evaluating distant consequences.

“Because their own money is at stake, participation in the market causes people to attend to and inevitably become more concerned about what’s happening to climate. All the information is coming at us,” MacIver said. “It’s just like buying a car and suddenly you see your car everywhere. They were all there before, but now you notice them. The same thing happens with climate; as soon as your motivation to attend goes up, you suddenly start to notice all these stories in your media feed that were there before, but you just didn't pay a lot of attention to since it’s somewhat scary and sad.

“If you buy stock in the climate, you tend to pay attention to climate news. That climate news is not very promising. It’s pretty worrisome.”

Well, only if you’re familiarizing yourself with the news.

“I think we're all very good at keeping ourselves in a bubble of contentment, that we've got lives to lead and kids to feed and jobs to go to in the morning and commutes to do,” MacIver said. “It's too challenging to also think about what we’re going to do about climate every day. What participation in the market does is, it shifts your mind very subtly toward those information sources that were already present and helps you pay more attention.”